1. Review Your Credit Report

Cigarette Expense in a Bankruptcy

The cigarette expense includes money used to buy cigarettes for the Debtor's mother, who lives with the Debtor and whose social security benefits supplement the Debtor's income.[46] In the continuation sheet attached to her amended Schedule J, the Debtor discloses that she and her mother smoke about 35 packs of cigarettes between them each month.[47] At trial, the Debtor stated that she had attempted to quit smoking, unsuccessfully.[48] She also stated that she believed she was entitled to smoke, as it was her only source of relaxation.[49]

Chapter 11 vs. Chapter 13 plans

Chapter 11 vs. Chapter 13 plans

This serves as a lesson for Chapter 13 bankruptcy attorneys about the importance of creating a plan that will be accepted by your clients' creditors as well as the court. In Chapter 11 cases, a plan must designate classes of claims and interests for treatment under a reorganization plan. 11 U.S.C. §1123(a)(1) Usually a Chapter 11 plan classifies claim holders as secured, unsecured with priority, unsecured, and equity security.

Get Rid Of Judgments

Judgments! How do they affect you? What can you do to get rid of them? How much do they really cost you? You owe a creditor some money. You can't pay! You just don't have the cash and there is nothing left in your budget. You tell the creditors, but they just want their money! This is how it usually starts out. You have every intention of paying your bills, but you just can't for one reason, or another. The creditor decides to take its debt collection process a step further and starts a lawsuit against you. In most cases, there is nothing to defend. You know you owe the money. The bottom line: the creditor gets a judgment against you. In California, the entry of a judgment against you can cause a creditor to put a lien on all real property you have in the County where the judgment is recorded with the county recorder. The judgment lien is like having a creditor get an additional mortgage against your property. Worse, assuming there is some value in your real property above the mortgages, the creditor may well be able to put your real property up for sale at public auction. Judgment creditors can also garnish your wages and levy your bank accounts.. The judgment lien is like having a creditor get an additional mortgage against your property. Worse, assuming there is some value in your real property above the mortgages, the creditor may well be able to put your real property up for sale at public auction. This would be a tough way to lose your home.

Pay Off Credit Cards Before Bankruptcy?

Dear Bankruptcy Attorney,

I am most likely going to file bankruptcy in a couple of months. I have two credit cards that I have been using and for the most part paying off every month. My questions are: If I pay off these two cards, will that be considered preferential payment and cause me problems in the bankruptcy? And the second question: If any cards have a zero balance when I file, will that credit card account be closed by the bankruptcy, or will I be able to maintain it in good standing albeit at a higher interest rate and likely much smaller limit?

- Jason

Pro's and Con's to Bankruptcy

There are many advantages of Bankruptcy for instance; the bankruptcy mostly provides relaxation from debts getting out of control. Debts controlled earlier or discharged such as credit card debts can get you out of stress and improve your life in various aspects. If you qualify (which you can find out by contacting us for a consultation), you will feel freedom from taxes and you can have a new start by having a legal freedom through bankruptcy.

Fact vs. Fiction about Bankruptcy

FAQ's

7 Common Question/Faq's about Bankruptcy

Myths and misconceptions often prevent you from making a sound decision. The attorneys at Forghany law P.C will take the time to help you fully understand your legal options. We have listed the 7 most common myths about bankruptcy:

What does a Bankruptcy cost?

Forghany Law, P.C. understands the financial struggles their clients face when filing for bankruptcy. Our goal is to provide high quality legal representation at an affordable price. Each case is unique, and we strive to provide clients with many fee options including payment plans. Forghany Law, P.C, tries to suit the needs of our clients. Contact one of our dedicated attorneys to request more information about bankruptcy costs and our payment plans. We are more than happy to answer as many questions as you may have. We offer a FREE consultation. Legal Fees

What is Bankruptcy all about?

Well, let me tell you a little bit about Bankruptcy. It's really all about getting a fresh start. There are a lot of misconceptions. You don't need to have a huge yard sale and sell all of your stuff, or keep the heat on 50 and eat beans out of a can by candle light. You can keep all of your possessions. You can keep your car and home if you are current on the payments. You can keep your golf clubs, your boat, your electronics, your computers etc. However, you need to be honest with the Attorney about all of your assets and liabilities so that The Firm can protect you.

Hello world!

Welcome to Bankruptcy Help Info!

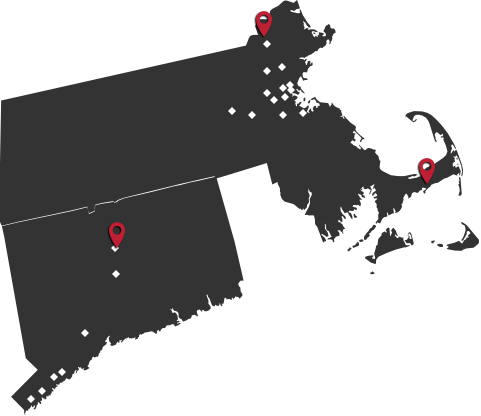

This is where people come to learn more about Chapter 7 and Chapter 13 Bankruptcy's for Massachusetts and Connecticut.