There are many advantages of Bankruptcy for instance; the bankruptcy mostly provides relaxation from debts getting out of control. Debts controlled earlier or discharged such as credit card debts can get you out of stress and improve your life in various aspects. If you qualify (which you can find out by contacting us for a consultation), you will feel freedom from taxes and you can have a new start by having a legal freedom through bankruptcy.

Bankruptcy often remains with the only choice for you to save you from home foreclosure and keeps all your creditors away from you so that they may not take action against you after bankruptcy is filled. You must response quickly if you feel yourself indulged in such situations, consult us, because responding with bankruptcy can save you from some serious harms like tax lien or an encroaching foreclosure date.

Most of the time people get worried about credit on filing bankruptcy. But there is no need to get worry about anything because your credit is already damaged and as a consequence you have to face bankruptcy. Whenever you feel yourself in such situation, you can clear you credit balances bankruptcy is very helpful to clear credit balances, makes you qualify for new loans, and re-construct your credit history by making timely payments.

Cons of Bankruptcy

Bankruptcy remains the part of the credit history for a long time like the chapter 7 bankruptcy stays on your credit report for 10 years and chapter 13 bankruptcy remains on your credit report for seven years. The time period starts once the case is filed not after the case is discharged or concluded. Before filing the bankruptcy most of the people already have damaged credit history like missing the debt payments, legal suits against them and foreclosures. All the credit history stays as your credit report for seven years. This is very important to consider that how filing the bankruptcy will influence my credit and credit report? There is no doubt that it will have some negative impact but most of the time the negative impacts are exaggerated. You can rearrange your credit after bankruptcy even if it is appearing on your credit report. It plays a significant role on your credit report but its significance can be minimized by other positive factors. Many people reported us about the easy availability of credit even after bankruptcy on their credit reports.

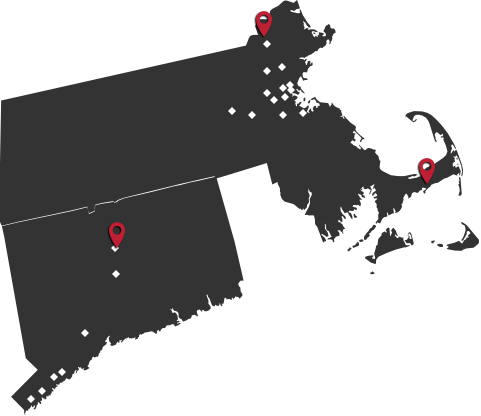

We provide assistance to our clients in Massachusetts and Connecticut after or during the bankruptcy to ensure the accuracy of their credit reports. In this way, our clients are provided with improved credit score and they may attain new credit facilities on easy and manageable terms.

Because you are facing credit problems in your credit reports or in any situation you have to file the bankruptcy, you will have some obligations regarding the petition. You will have to present yourself in the court and we will assist you with all the procedures. It is not much painful as it is perceived. In a chapter 7 bankruptcy you may sometimes lose your property such as if you own more than your exemption limits. Bankruptcy will not discharge some of your debts such as student loans. It is important to know that on filing bankruptcy you will not be prevented to get the student loans in the future that are guaranteed by the Government such as Stafford, Perkins etc. There may be some other situations for which law prevents you to get the student loans. Our attorneys and lawyers are in contact with many consumers and small business owners around Massachusetts and Connecticut to discuss the debt problems. We recommend that in most of the situations bankruptcy turns out to be the most feasible solution.

No Comments

Leave a comment