MASSACHUSETTS DEBT RELIEF BANKRUPTCY ATTORNEY

>

>CONTACT US FOR HIRING A BANKRUPTCY LAWYER IN BOSTON AND HARTFORD

Receiving past due notices accompanied by late fees and penalties which are potentially followed later by summons to appear in court, can be a very nerve racking situation. If unresolved, liens, court orders, garnishments, and/or foreclosures could be issued. At that point, emotional confusion is usually joined by legal confusion and by frustration regarding whom to hire and why. Why wait that long to consider the best options?

Choosing a bankruptcy lawyer doesn't have to be difficult or frustrating. At Forghany Law, P.C., our primary practice of law is Bankruptcy, we are familiar with the local rules and trustees, we have reasonable fees and we can definitely help.

We begin by assuring you truthfully that you may not need an attorney. Are you faced with a situation where creditors just need a phone call to adjust interest rates and reduce payments that will likely fix the overall problem and allow you to pay the creditor and still save money each month for emergencies? We are not looking to just take your money. We will not obtain "an easy thousand" by providing unnecessary services. We also occasionally return portions of our retainer fee. A common reply to our advice and services is, "Thanks for being so honest and straight forward."

Another significant consideration is to contact a bankruptcy attorney promptly! Not considering whether you'll need an attorney's assistance, it's good to know your rights as soon as possible. Why wait until the creditors have taken legal action before knowing your options? By educating yourself with all possible options and having someone knowledgeable on your side as soon as possible, you will better your chances for a favorable outcome.

Attorney Forghany and her staff can proficiently answer important questions. Are you faced with bill collectors harassing you over past due payments? Do consistent late payments cause additional fees and charges to be added to your total bill? How will a divorce affect my financial matters? How will the loss of my job effect my situation? When doing the math, will the bills be paid off in more than three to five years? Are you comfortable with the total amount of money it will cost you to pay off all your debts? (Visit http://www.bankrate.com/calculators/credit-cards/credit-card-minimum-payment.aspx to find out how much you will pay in total) Are you seeking relief from all the stress of a severe debt load and a financial hardship prohibits sufficient repayment?

Don't hesitate. Little decisions now can have a significant impact later. For more information, contact us in our Massachusetts or Connecticut offices.

At Forghany Law, P.C., we know that your bankruptcy is only part of your concern: You also want to get back to a normal life. This includes rebuilding your credit score as fast as possible.

For years, we have been meeting with clients who are terrified about the future: How will you survive in a world that will judge you based on your credit score?

You need credit to rent an apartment, buy a car. In fact, more and more, employers are running credit checks on potential employees.

We've listened to your concerns and then we found answers.

In our research, we've discovered a few things:

- If you take immediate steps to start rebuilding your credit score after a bankruptcy, you can transform your credit score 12 to 24 months after your bankruptcy has been discharged.

- You must take these steps. Too many people decide to wipe their hands clean of credit. As time passes, instead of having poor credit, they end up with no credit. Unfortunately, no credit is just as bad as poor credit.

- Because our clients are so concerned about their credit, we searched high and low for the best credit education program out there. After testing the program, we learned that people who have been through the credit program we offer transform their credit scores, usually within 24 months of declaring bankruptcy.

- With these kinds of results, we decided to make this program available to every single one of our bankruptcy clients.

Every client filing for bankruptcy needs to complete a pre-filing credit counseling and a pre-discharge debtor education course and submit the certificate numbers to the U.S. Bankruptcy Trustee. These courses carry an expense to clients of most other law firms. Forghany Law, P.C. will cover the cost of the course fees for our clients which means the course fees will be free to you where these fees may be an additional cost with other attorneys.

CONTACT US

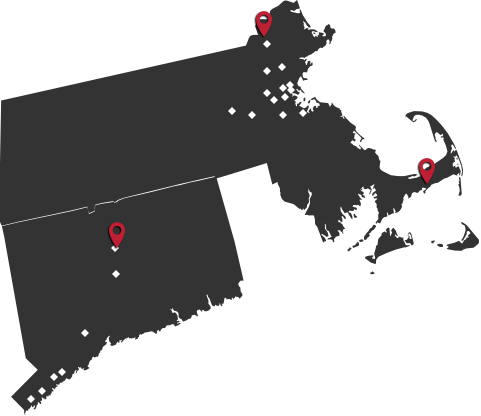

Forghany Law, P.C. of Attorney Lamya Forghany is located 1 Canal St., Lawrence, MA at the wonderfully restored mill building, originally the Everett Cotton Mills, is at the entrance of the Lawrence Gateway, less than a mile from Route 495 and just across the way from the Lawrence General Hospital. It is on the MVRTA line and is walking distance from McGovern Transportation Center giving commuters access to the MBTA Commuter rail - Haverhill branch. This is one of the best locations in Lawrence with plenty of free parking. Our other office is at 100 Pearl St. 14th Floor in Hartford CT with satellite offices in Shelton CT, Marlborough MA, Boston MA , Braintree MA, and Framingham MA.

We accept all major credit cards and we are easily reached: simply call