LIQUIDATE YOUR DEBTS AND MAKE A FRESH START

Chapter 7 is the most common type of bankruptcy and is often called "liquidation" bankruptcy. In Chapter 7 bankruptcy, some of your property may be sold ("liquidated") to pay back a portion of your debt. In return, most or all of your unsecured debts (debts not secured by collateral) will be eliminated.

You get to keep any belongings that are classified as "exempt" under applicable state or federal laws. Household furnishings, clothes, some homes and some cars qualify as exempt property. The Chapter 7 process usually lasts four to six months and is designed for people who do not have a regular income, or whose income falls below a certain threshold.

MANY PEOPLE BELIEVE THEY WILL LOSE EVERYTHING THEY OWN WHEN THEY FILE FOR CHAPTER 7 BANKRUPTCY. THE TRUTH IS THAT MANY INDIVIDUALS WHO FILE FOR CHAPTER 7 ARE ABLE TO KEEP MOST OR ALL OF THEIR PROPERTY BECAUSE IT IS EXEMPT.

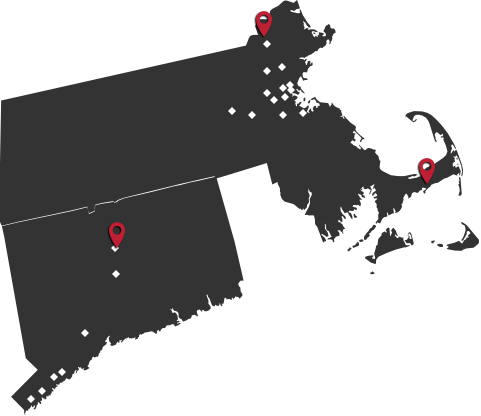

Contact us to schedule a free, confidential consultation to discuss your situation. Our Lawrence Chapter 7 attorneys represent clients in both Massachusetts and Connecticut.

ELIMINATE CREDIT CARD AND MEDICAL DEBT

Chapter 7 can be used to eliminate debts that include:

- Credit card debt

- Medical debt

- IRS tax debt

- Some second mortgages and home equity lines of credit

- Utility bills

- Finance company and payday loans

- Personal loans

High Income Debtors May Still Qualify For Chapter 7

The federal government has devised a "means test" to determine whether individuals qualify for Chapter 7 bankruptcy protection. Even if you have a high income or considerable assets, you still may qualify for Chapter 7. For example, a small-business owner whose business contributed to more than 50 percent of his or her debt is not subject to the "means test" used to determine eligibility. Even if you do not qualify for Chapter 7, we will help you consider all of your options - including filing for Chapter 13 bankruptcy.

We Will Guide You Through The Bankruptcy Process

At Forghany Law P.C., our lawyers will give you the information you need to make an informed decision. When you work with our team, we will walk you through every step of the bankruptcy process and provide objective advice about your specific situation. We have helped hundreds of people protect property, get out of debt and start on a fresh new path.

SERVING HARTFORD: PERSONAL BANKRUPTCY ATTORNEYS

Contact Forghany Law P.C. to schedule a free Chapter 7 bankruptcy consultation. In Massachusetts, we can be reached at

Forghany Law P.C. is a debt relief agency. We help people file for bankruptcy under the Bankruptcy Code.