Being harassed by any creditor can be stressful, but the IRS is often the most intimidating. If your debt includes unpaid taxes, penalties and interest, an experienced bankruptcy attorney can address these problems effectively. Our lawyers can advise you about your repayment options and explain which tax debts can be discharged. We can also discuss bankruptcy's effect on your income tax refund.

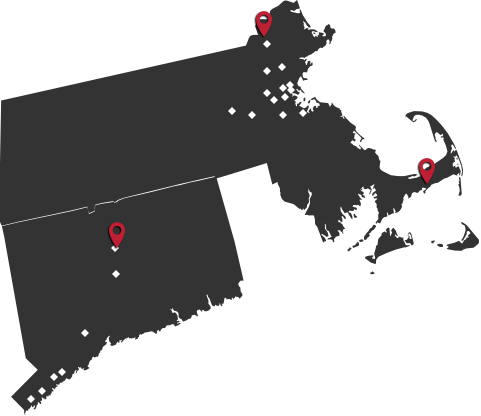

Contact Forghany Law P.C. for a free initial consultation in Hyannis, Lawrence or one of our other locations. Call our bankruptcy attorneys in Massachusetts at

Discharge Your Old Income Tax Debt

If your tax debt is more than three years old and meets certain other requirements, you will most likely be able to discharge it in a Chapter 7 or 13 bankruptcy filing. Our attorneys can also help you eliminate your penalties and interest. Many debtors are relieved to learn that the automatic stay that ends creditor harassment also stops the IRS from contacting them.

When we meet with you to discuss your case, we will examine the documents pertaining to your tax debt. Our lawyers can determine whether or not your tax debt meets the legal requirements for discharge in bankruptcy and help you choose the most beneficial course of action.

Protecting Your Refund

We know how important a tax refund can be to family that is struggling financially. The bankruptcy court generally requires debtors to put a refund toward their debts, but there are exceptions in some circumstances. Our firm can assess your case and outline the strategies that may allow you to keep your tax refund.

Contact Us For More Information

Tax issues are complicated and every situation is different. Contact our experienced lawyers online to schedule a free consultation or call us at

Se habla español.

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.